The global robot vacuum market continues to experience unprecedented growth, driving demand for high-quality replacement components and accessories. As wholesale buyers navigate this expanding landscape, understanding the intricacies of robot vacuum parts selection becomes crucial for maintaining competitive advantage and customer satisfaction. The complexity of modern robotic cleaning systems requires careful consideration of compatibility, quality standards, and supply chain reliability when sourcing components for international distribution.

Successful wholesale procurement in the robotic vacuum industry demands comprehensive knowledge of component specifications, manufacturing standards, and market trends. Professional buyers must evaluate multiple factors including material durability, compatibility matrices, and regional compliance requirements. The strategic selection of robot vacuum parts directly impacts end-user satisfaction, warranty claims, and long-term business relationships with retail partners.

Essential Component Categories for Wholesale Distribution

Primary Cleaning Elements and Consumables

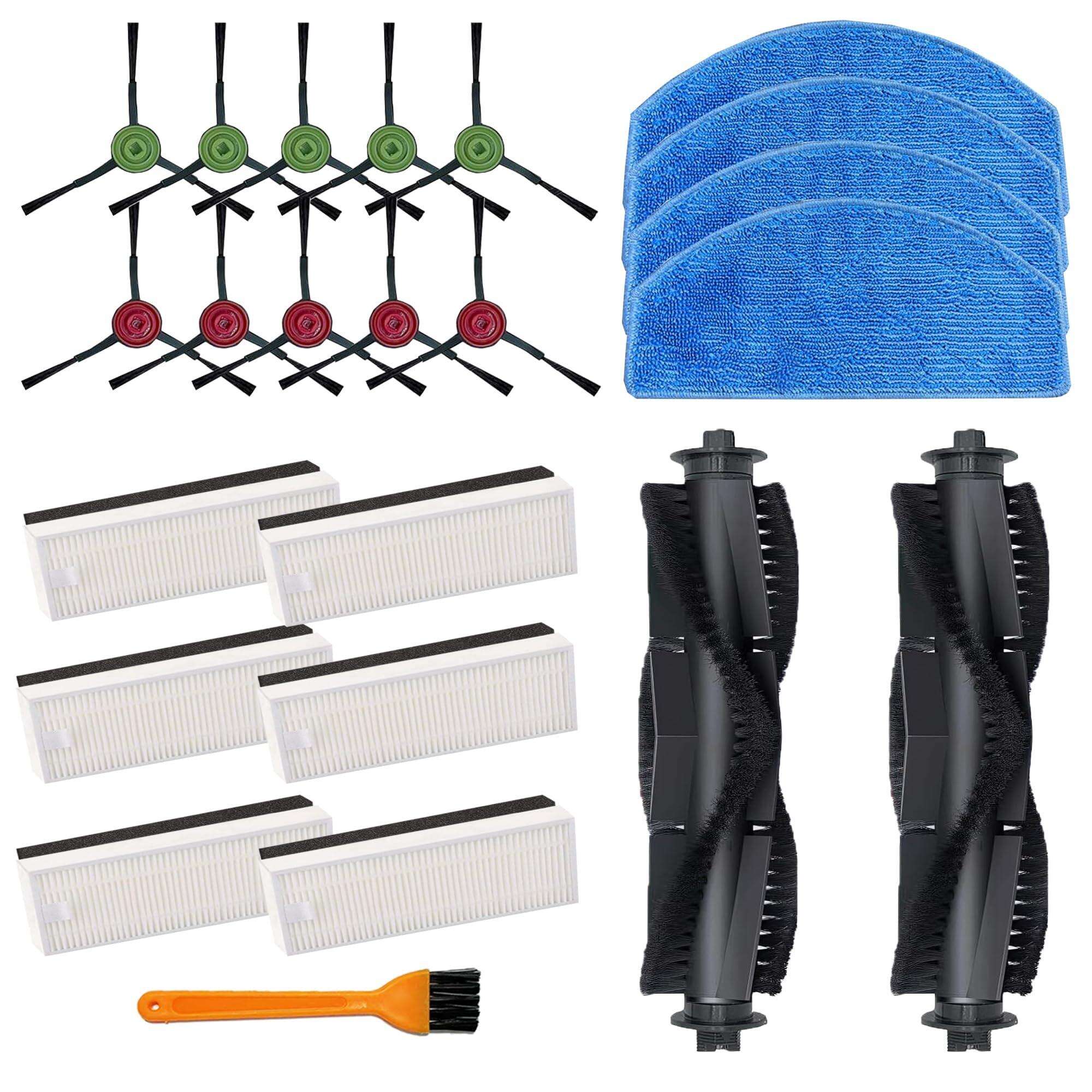

The foundation of any robot vacuum parts inventory centers around primary cleaning components that require regular replacement. These consumable items represent the highest-volume sales opportunities for wholesale distributors, as end-users typically replace them every three to six months depending on usage patterns. Brush assemblies, including main brushes, side brushes, and specialized pet hair extractors, constitute the core of this category.

Filter systems represent another critical component category, with HEPA filters, pre-filters, and exhaust filters serving different purification functions. Modern robotic vacuums often incorporate multi-stage filtration systems that require compatible replacement parts meeting specific micron ratings and airflow specifications. Wholesale buyers should prioritize suppliers offering comprehensive filter compatibility charts and performance certifications.

Electronic Components and Sensors

Advanced robot vacuum systems rely heavily on sophisticated electronic components that occasionally require replacement or upgrade. Navigation sensors, including LiDAR modules, camera assemblies, and infrared sensors, represent high-value replacement parts with significant technical complexity. Battery systems, charging docks, and power management modules also fall within this category, requiring careful attention to voltage specifications and safety certifications.

Wholesale distributors must establish relationships with suppliers capable of providing genuine electronic components with proper documentation and warranty support. The proliferation of counterfeit electronic parts in the market makes supplier verification and quality assurance protocols essential for protecting both business reputation and customer safety.

Quality Assessment and Compatibility Standards

Manufacturing Quality Indicators

Evaluating manufacturing quality requires systematic assessment of material composition, dimensional accuracy, and production consistency. Professional-grade robot vacuum parts should demonstrate precise tolerances, appropriate material selection, and consistent surface finishes. Injection-molded components must exhibit uniform wall thickness, proper gate placement, and minimal flash or parting line visibility.

Testing protocols for quality assessment should include dimensional verification, material hardness testing, and accelerated wear simulation. Reputable suppliers provide comprehensive quality documentation, including material certificates, dimensional inspection reports, and performance validation data. Wholesale buyers should establish clear acceptance criteria and implement incoming inspection procedures to maintain quality standards.

Cross-Brand Compatibility Considerations

The robotic vacuum industry features numerous proprietary designs and mounting systems that complicate parts compatibility across different brands and models. Successful wholesale operations require detailed compatibility matrices that accurately identify interchangeable components while highlighting brand-specific requirements. Universal parts that fit multiple models offer significant inventory advantages but may compromise optimal performance characteristics.

Compatibility verification involves physical fit testing, performance validation, and long-term durability assessment. Professional buyers should maintain comprehensive databases documenting successful cross-platform applications while identifying potential compatibility issues or performance limitations. This information becomes invaluable for customer support and technical consultation services.

Supply Chain Management and Sourcing Strategies

Supplier Evaluation and Selection Criteria

Establishing reliable supplier relationships requires comprehensive evaluation of manufacturing capabilities, quality systems, and business stability. Key evaluation criteria include ISO certification status, production capacity, lead time consistency, and financial stability. Suppliers should demonstrate robust quality management systems with documented procedures for design control, process validation, and corrective action implementation.

Geographic diversification of supplier base helps mitigate supply chain risks while potentially reducing logistics costs through regional sourcing strategies. However, quality consistency across multiple suppliers requires standardized specifications, regular auditing, and performance monitoring systems. Professional wholesale buyers often implement supplier scorecards tracking delivery performance, quality metrics, and responsiveness indicators.

Inventory Management and Demand Forecasting

Effective inventory management for robot vacuum parts requires sophisticated demand forecasting considering seasonal variations, product lifecycle stages, and market penetration rates. Fast-moving consumable items like filters and brushes require different inventory strategies compared to slower-moving electronic components or specialty tools. Advanced inventory management systems should incorporate historical sales data, market trend analysis, and supplier lead time variability.

Safety stock calculations must account for supply chain uncertainties, seasonal demand fluctuations, and new product introductions. Professional distributors often implement vendor-managed inventory programs for high-volume items while maintaining strategic reserves for critical components. Regular inventory optimization reviews help identify slow-moving items and adjust purchasing strategies accordingly.

Market Trends and Future Considerations

Technological Evolution Impact

The rapid advancement of robotic vacuum technology continuously introduces new component requirements and obsoletes existing parts. Artificial intelligence integration, advanced mapping capabilities, and enhanced cleaning algorithms drive demand for upgraded sensors, processors, and mechanical components. Wholesale buyers must stay informed about emerging technologies and their implications for parts inventory planning.

Sustainability initiatives increasingly influence component design and material selection, with manufacturers adopting recyclable materials and modular construction approaches. These trends create opportunities for eco-friendly replacement parts while potentially disrupting traditional supply chains. Forward-thinking wholesale operations should evaluate suppliers based on environmental compliance and sustainable manufacturing practices.

Regional Market Variations

Different geographic markets exhibit varying preferences for robot vacuum features, performance characteristics, and price points. These regional variations directly impact parts demand patterns, with some markets favoring high-filtration systems while others prioritize extended battery life or enhanced navigation capabilities. Successful global wholesale operations tailor their parts inventory to match regional market preferences and regulatory requirements.

Regulatory compliance requirements vary significantly across international markets, affecting component specifications, safety certifications, and documentation requirements. Professional buyers must understand applicable standards including CE marking, FCC certification, and RoHS compliance. Maintaining region-specific inventory segments helps ensure compliance while optimizing customer service capabilities.

Cost Optimization and Pricing Strategies

Volume Purchasing and Negotiation Tactics

Effective cost management in robot vacuum parts procurement relies heavily on strategic volume purchasing and supplier relationship development. Professional buyers should analyze annual consumption patterns to identify opportunities for consolidated purchasing agreements that leverage volume discounts. Multi-year contracts with volume commitments often secure preferential pricing while providing supply security for critical components.

Negotiation strategies should consider total cost of ownership including transportation, handling, and inventory carrying costs rather than focusing solely on unit prices. Collaborative planning with suppliers can identify cost reduction opportunities through design optimization, packaging improvements, or logistics efficiency enhancements. Regular market price analysis helps maintain competitive positioning while ensuring fair supplier margins.

Value-Added Services and Differentiation

Successful wholesale operations differentiate themselves through value-added services that extend beyond basic parts supply. Technical support services, installation guides, and compatibility consultation help customers maximize their robot vacuum parts investment while reducing support burden on manufacturers. Custom packaging, private labeling, and co-branded marketing materials create additional revenue opportunities while strengthening customer relationships.

Educational resources including maintenance schedules, troubleshooting guides, and performance optimization tips enhance customer satisfaction while potentially increasing parts consumption. Digital platforms providing parts lookup tools, compatibility checking, and ordering convenience create competitive advantages in increasingly digital marketplaces. These services justify premium pricing while building customer loyalty and repeat business.

FAQ

What are the most important factors when selecting robot vacuum parts suppliers

The most critical factors include manufacturing quality certifications, production capacity consistency, and comprehensive compatibility documentation. Suppliers should demonstrate ISO certification, provide detailed quality control procedures, and offer technical support for compatibility questions. Financial stability and geographic diversification capabilities also play important roles in long-term supplier relationships.

How can wholesale buyers ensure parts compatibility across different robot vacuum brands

Maintaining detailed compatibility matrices and conducting physical fit testing are essential for ensuring proper parts compatibility. Professional buyers should work with suppliers who provide comprehensive compatibility documentation and offer technical support for cross-brand applications. Regular testing of universal parts across multiple models helps identify potential issues before customer delivery.

What inventory levels should wholesale distributors maintain for different component categories

Inventory levels should reflect demand velocity, supplier lead times, and seasonal variations for each component category. Fast-moving consumables like filters and brushes typically require 60-90 days of stock, while slower-moving electronic components may need 90-120 days coverage. Safety stock calculations should account for supply chain variability and market growth projections.

How do regional regulations affect robot vacuum parts selection and distribution

Regional regulations significantly impact component specifications, safety certifications, and documentation requirements. European markets require CE marking and RoHS compliance, while North American markets need FCC certification for electronic components. Professional distributors should maintain region-specific inventory segments and work with suppliers who understand international compliance requirements.

Table of Contents

- Essential Component Categories for Wholesale Distribution

- Quality Assessment and Compatibility Standards

- Supply Chain Management and Sourcing Strategies

- Market Trends and Future Considerations

- Cost Optimization and Pricing Strategies

-

FAQ

- What are the most important factors when selecting robot vacuum parts suppliers

- How can wholesale buyers ensure parts compatibility across different robot vacuum brands

- What inventory levels should wholesale distributors maintain for different component categories

- How do regional regulations affect robot vacuum parts selection and distribution