The global robotic vacuum cleaner market has experienced unprecedented growth, creating substantial opportunities for distributors seeking to capitalize on this expanding sector. Understanding the specific characteristics that make robot vacuum parts suitable for large-scale distribution is crucial for businesses looking to establish successful supply chains in this competitive marketplace. Quality robot vacuum parts must meet stringent durability standards while maintaining cost-effectiveness for bulk distribution channels.

Distribution success in the robot vacuum component industry depends heavily on selecting parts that demonstrate consistent performance across diverse operating conditions. Modern consumers expect their automated cleaning devices to function reliably for extended periods, making component durability a primary concern for distributors. The most successful distribution networks focus on sourcing components that balance premium quality with competitive pricing structures suitable for volume purchasing agreements.

Market research indicates that distributors who prioritize standardized compatibility and universal fitment experience significantly higher customer satisfaction rates. This approach reduces inventory complexity while expanding potential market reach across multiple robotic vacuum brands and models. Effective distribution strategies must also account for seasonal demand fluctuations and regional preferences that influence component selection and procurement timing.

Essential Quality Standards for Distribution-Ready Components

Material Durability and Performance Specifications

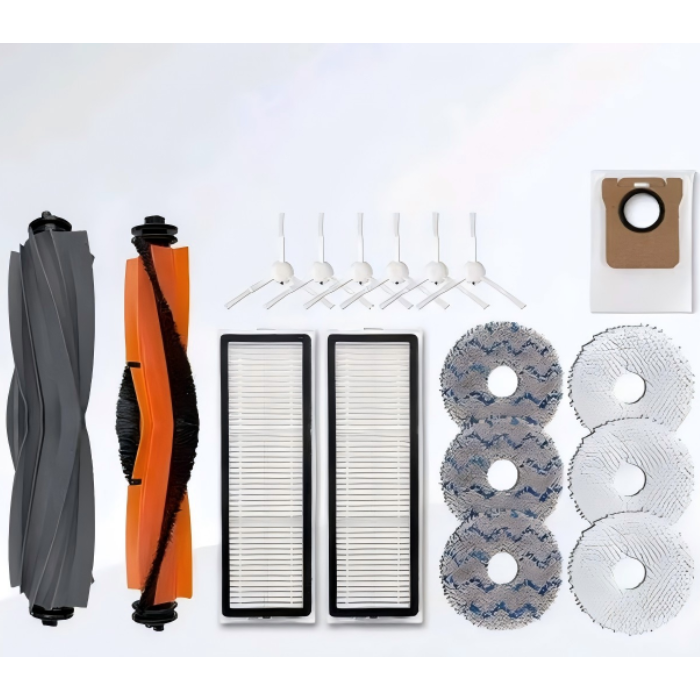

High-quality robot vacuum parts designed for distribution must incorporate advanced materials that withstand continuous mechanical stress and environmental challenges. Premium components typically feature reinforced plastic housings, corrosion-resistant metal elements, and specialized synthetic materials engineered for extended operational lifecycles. These material specifications directly impact the long-term reliability expectations that distributors must guarantee to their retail partners.

Manufacturing standards for distribution-grade components require comprehensive testing protocols that simulate real-world usage patterns over extended timeframes. Quality assurance processes must verify that individual parts maintain consistent performance characteristics throughout their expected service intervals. Distributors benefit significantly from partnering with manufacturers who provide detailed performance documentation and warranty support for their component offerings.

The most successful robot vacuum parts in distribution channels demonstrate measurable improvements in cleaning efficiency, noise reduction, and energy consumption compared to standard replacement options. These performance advantages create compelling value propositions that distributors can leverage when negotiating with retail customers and service providers. Advanced component designs often incorporate innovative features such as self-cleaning mechanisms and intelligent wear indicators that enhance overall system reliability.

Compatibility and Universal Design Principles

Universal compatibility represents a fundamental requirement for robot vacuum parts intended for large-scale distribution networks. Components designed with standardized mounting systems and connection interfaces significantly reduce inventory management complexity while expanding market applicability. This design approach enables distributors to serve diverse customer bases without maintaining extensive model-specific component libraries.

Cross-brand compatibility features allow distributors to position their robot vacuum parts as premium universal solutions that deliver superior value compared to manufacturer-specific alternatives. This positioning strategy creates opportunities for higher profit margins while addressing the growing consumer preference for aftermarket components that offer enhanced performance characteristics. Standardized designs also facilitate bulk packaging and shipping efficiencies that improve overall distribution economics.

Engineering teams focused on distribution-ready components prioritize modular design concepts that enable easy installation and maintenance procedures. These user-friendly characteristics reduce technical support requirements while encouraging customer loyalty through positive ownership experiences. Simplified installation processes also reduce the burden on retail partners who may lack specialized technical expertise for complex component replacements.

Market Positioning and Competitive Advantages

Cost-Effectiveness and Volume Pricing Strategies

Successful distribution of robot vacuum parts requires carefully structured pricing models that accommodate various market segments while maintaining healthy profit margins throughout the supply chain. Volume-based pricing tiers enable distributors to offer competitive rates for bulk purchases while incentivizing larger order quantities that improve operational efficiency. These pricing structures must account for manufacturing economies of scale and transportation cost optimizations that benefit all supply chain participants.

Market analysis reveals that distributors who implement flexible pricing strategies based on customer type and order volume achieve superior market penetration rates. Professional service providers, retail chains, and individual consumers each represent distinct market segments with unique pricing sensitivity characteristics. Effective distribution strategies accommodate these differences through tiered pricing models that maximize revenue potential across all customer categories.

Component sourcing strategies must balance initial acquisition costs with long-term customer satisfaction metrics to ensure sustainable business growth. Premium robot vacuum parts may command higher wholesale prices but often deliver superior customer retention rates through enhanced performance and reliability. This trade-off analysis requires sophisticated market intelligence and customer feedback systems that inform optimal product selection decisions.

Brand Recognition and Quality Assurance

Establishing strong brand recognition for robot vacuum parts within distribution channels requires consistent quality delivery and effective marketing support from component manufacturers. Distributors benefit from partnering with suppliers who invest in brand development activities such as consumer education programs, technical documentation, and professional training resources. These support services enhance the perceived value of distributed components while reducing customer acquisition costs.

Quality certification programs and industry compliance standards provide distributors with powerful differentiation tools in competitive markets. Components that meet or exceed recognized quality standards enable distributors to command premium pricing while building customer confidence in their product offerings. Certification documentation also simplifies the sales process by providing objective performance validation that supports purchasing decisions.

Customer testimonials and performance case studies represent valuable marketing assets that distributors can leverage to expand their market reach. Successful robot vacuum parts generate positive user experiences that translate into word-of-mouth referrals and repeat business opportunities. Distributors who actively collect and promote customer feedback create compelling evidence of component quality that supports premium positioning strategies.

Supply Chain Optimization and Logistics Considerations

Inventory Management and Demand Forecasting

Effective inventory management for robot vacuum parts distribution requires sophisticated demand forecasting systems that account for seasonal variations, product lifecycle stages, and emerging market trends. Successful distributors implement predictive analytics tools that analyze historical sales data, consumer behavior patterns, and competitive market dynamics to optimize stock levels. These systems help prevent costly stockouts while minimizing excess inventory carrying costs that erode profit margins.

Regional demand variations significantly impact optimal inventory distribution strategies for robot vacuum components. Urban markets typically demonstrate higher demand for premium replacement parts, while rural areas may prioritize cost-effective basic components. Understanding these geographic preferences enables distributors to allocate inventory resources efficiently while maximizing customer satisfaction across diverse market segments.

Just-in-time inventory principles can be particularly effective for robot vacuum parts distribution when properly implemented with reliable supplier relationships. This approach reduces warehouse overhead costs while ensuring product freshness for components with limited shelf life considerations. However, successful just-in-time strategies require robust supplier communication systems and backup inventory plans to prevent service disruptions during peak demand periods.

Packaging and Shipping Optimization

Packaging design for robot vacuum parts distribution must balance protection requirements with cost efficiency and environmental sustainability considerations. Components require adequate cushioning and moisture protection during transportation while minimizing package dimensions to optimize shipping economics. Innovative packaging solutions often incorporate recyclable materials and space-efficient designs that reduce transportation costs per unit.

Bulk packaging strategies for distribution channels differ significantly from retail packaging requirements, focusing primarily on protection and handling efficiency rather than consumer appeal. Professional-grade packaging systems enable automated handling processes that reduce labor costs while maintaining component integrity throughout the distribution process. These packaging innovations often include standardized dimensions that optimize warehouse storage density and transportation vehicle utilization.

International shipping considerations become particularly important for robot vacuum parts distributors serving global markets. Components must comply with various regulatory requirements and packaging standards specific to different countries and regions. Successful international distributors develop expertise in customs documentation, hazardous materials classification, and regional quality certification requirements that facilitate smooth cross-border transactions.

Technology Integration and Digital Distribution Platforms

E-commerce Platform Integration

Modern robot vacuum parts distribution increasingly relies on sophisticated e-commerce platforms that streamline ordering processes and enhance customer experience quality. These digital systems enable real-time inventory visibility, automated order processing, and integrated shipping management that reduces operational overhead while improving service quality. Advanced platforms also provide valuable analytics data that inform strategic decision-making and market development initiatives.

Mobile-responsive distribution platforms accommodate the growing preference for smartphone-based ordering among professional customers and individual consumers. These mobile-optimized systems must provide comprehensive product information, compatibility verification tools, and simplified checkout processes that encourage customer adoption. Integration with popular mobile payment systems further enhances user convenience while reducing transaction friction.

Automated customer notification systems keep distributors connected with their customer base through order status updates, shipping notifications, and proactive maintenance reminders. These communication tools enhance customer satisfaction while creating opportunities for additional sales through targeted product recommendations. Advanced systems can even predict customer needs based on purchase history and usage patterns to suggest optimal reordering schedules.

Data Analytics and Market Intelligence

Comprehensive data analytics capabilities enable robot vacuum parts distributors to identify emerging market trends and optimize their product portfolios accordingly. These systems analyze customer purchasing patterns, seasonal demand fluctuations, and competitive pricing dynamics to inform strategic planning decisions. Real-time market intelligence helps distributors respond quickly to changing market conditions while maintaining competitive advantages.

Customer behavior analytics provide valuable insights into preferences and purchasing triggers that influence component selection decisions. This information enables distributors to refine their marketing strategies and inventory allocation plans to better serve target market segments. Advanced analytics platforms can even identify potential quality issues early through pattern recognition in customer feedback and return data.

Predictive maintenance scheduling represents an emerging application of data analytics in robot vacuum parts distribution. These systems analyze usage patterns and component wear rates to predict optimal replacement schedules for customers. This proactive approach creates opportunities for subscription-based service models that provide recurring revenue streams while enhancing customer convenience and equipment reliability.

FAQ

What quality certifications should distributors look for in robot vacuum parts

Distributors should prioritize robot vacuum parts that carry ISO 9001 quality management certification, CE marking for European compliance, and FCC certification for electronic components. Additionally, look for parts that meet RoHS environmental compliance standards and have undergone third-party testing for durability and performance. These certifications provide assurance of consistent quality and regulatory compliance across international markets.

How do universal compatibility features benefit large-scale distribution

Universal compatibility significantly reduces inventory complexity by allowing distributors to stock fewer SKUs while serving more customers. This approach improves inventory turnover rates, reduces storage costs, and simplifies customer service processes. Universal parts also enable distributors to capture market share from customers who own multiple robot vacuum brands or prefer aftermarket components over manufacturer-specific alternatives.

What factors determine optimal inventory levels for robot vacuum parts distribution

Optimal inventory levels depend on seasonal demand patterns, supplier lead times, customer order frequency, and storage capacity constraints. Distributors should analyze historical sales data, consider product lifecycle stages, and account for promotional activities when setting stock levels. Implementing automated reorder points based on velocity analysis and safety stock calculations helps maintain service levels while minimizing carrying costs.

How can distributors differentiate their robot vacuum parts offerings in competitive markets

Successful differentiation strategies focus on superior customer service, comprehensive technical support, competitive pricing for volume purchases, and exclusive partnerships with innovative component manufacturers. Distributors can also add value through services such as compatibility verification, installation guidance, and preventive maintenance programs. Building strong relationships with retail partners and service providers creates additional competitive advantages through preferential treatment and collaborative marketing opportunities.

Table of Contents

- Essential Quality Standards for Distribution-Ready Components

- Market Positioning and Competitive Advantages

- Supply Chain Optimization and Logistics Considerations

- Technology Integration and Digital Distribution Platforms

-

FAQ

- What quality certifications should distributors look for in robot vacuum parts

- How do universal compatibility features benefit large-scale distribution

- What factors determine optimal inventory levels for robot vacuum parts distribution

- How can distributors differentiate their robot vacuum parts offerings in competitive markets