The vacuum cleaner accessories market has experienced unprecedented growth as consumers increasingly prioritize home maintenance and appliance longevity. Distributors operating in retail channels face the critical challenge of selecting the right vacuum replacement parts to meet diverse consumer demands while maximizing profitability. Understanding market dynamics, quality standards, and consumer preferences becomes essential for successful product sourcing and inventory management. The selection process involves analyzing compatibility requirements, evaluating supplier reliability, and ensuring compliance with safety standards that govern the vacuum cleaner industry.

Market Analysis for Vacuum Replacement Components

Consumer Demand Patterns

Understanding consumer purchasing behavior provides crucial insights for distributors selecting vacuum replacement parts inventory. Research indicates that consumers typically replace filters every three to six months, while brushes and belts require replacement annually depending on usage frequency. The demand for original equipment manufacturer components versus compatible alternatives varies significantly across different consumer segments. Price-conscious consumers often prefer compatible parts that offer similar performance at reduced costs, while premium segment customers prioritize authentic manufacturer specifications.

Seasonal fluctuations also impact replacement part sales, with peak demand occurring during spring cleaning periods and holiday seasons when intensive household cleaning activities increase. Distributors must anticipate these patterns to optimize inventory levels and prevent stockouts during high-demand periods. Geographic variations in consumer preferences require careful consideration, as urban markets may prioritize convenience and brand recognition, while rural customers often focus on durability and cost-effectiveness.

Product Category Performance

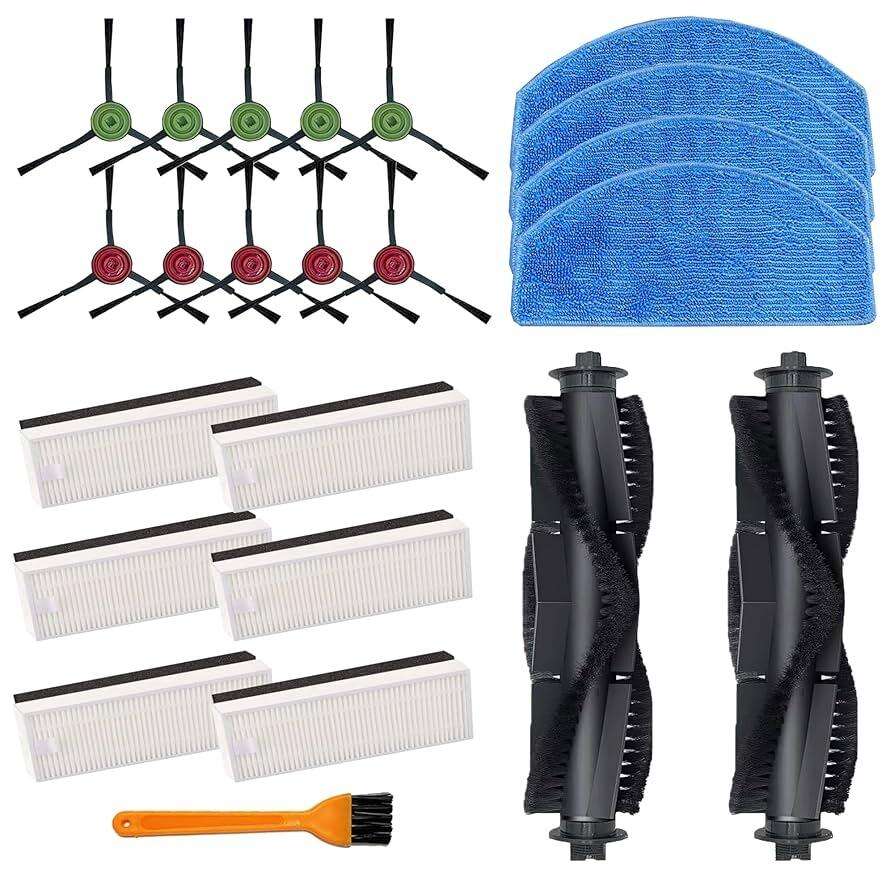

Different vacuum replacement parts categories exhibit varying profit margins and turnover rates that distributors must evaluate carefully. Filtration components, including HEPA filters and foam filters, typically generate steady recurring revenue due to regular replacement requirements. Brush assemblies, comprising main brushes and side brushes, represent higher-value items with extended replacement cycles but offer improved profit margins. Consumable items like dust bags maintain consistent demand across traditional vacuum cleaner models.

Emerging product categories include specialized cleaning cloths, sensor components, and smart vacuum accessories that cater to robotic vacuum systems. These advanced components often command premium pricing but require technical knowledge for proper customer support. Distributors should balance traditional high-volume categories with innovative products to capture both established and emerging market segments.

Quality Assessment and Supplier Evaluation

Manufacturing Standards and Certifications

Quality assessment remains paramount when selecting vacuum replacement parts suppliers for retail distribution. Manufacturers must demonstrate compliance with relevant safety standards, including electrical safety certifications and material composition regulations. International standards such as IEC and UL certifications provide assurance that products meet stringent safety and performance requirements. Distributors should verify supplier documentation and request third-party testing reports to validate quality claims.

Material quality directly impacts product longevity and customer satisfaction levels. Premium materials like high-grade plastics, reinforced bristles, and advanced filtration media justify higher wholesale costs through reduced return rates and enhanced customer loyalty. Suppliers should provide detailed material specifications, including chemical resistance properties and expected lifespan under normal operating conditions. Quality control processes at manufacturing facilities require regular auditing to ensure consistent product standards.

Supplier Reliability and Support Systems

Establishing reliable supplier relationships forms the foundation of successful vacuum replacement parts distribution operations. Suppliers must demonstrate consistent delivery performance, competitive pricing structures, and responsive customer service capabilities. Financial stability assessment helps ensure long-term partnership viability and reduces supply chain disruption risks. References from existing distribution partners provide valuable insights into supplier performance and reliability.

Technical support capabilities become increasingly important as product complexity advances, particularly for robotic vacuum components and smart accessories. Suppliers should offer comprehensive product training, installation guides, and troubleshooting resources that distributors can share with retail customers. Warranty policies and return procedures must align with distributor requirements and customer expectations to minimize operational complications.

Compatibility and Technical Specifications

Universal Compatibility Considerations

Compatibility assessment represents a critical factor in selecting vacuum replacement parts for diverse retail markets. Universal components that fit multiple vacuum models reduce inventory complexity while expanding potential customer base. Cross-reference databases help distributors identify which replacement parts work across different brands and model series. However, universal solutions may compromise optimal performance compared to manufacturer-specific components.

Technical specifications must align precisely with original equipment requirements to ensure proper functionality and safety. Dimensional accuracy, connection types, and performance characteristics require careful verification against manufacturer specifications. Distributors should maintain detailed compatibility charts and provide clear guidance to retail partners regarding proper application and installation procedures.

Innovation and Technology Integration

Technological advancement in vacuum cleaner design drives continuous evolution in replacement part requirements. Smart sensors, improved filtration systems, and enhanced brush technologies create opportunities for distributors to offer value-added products. However, these innovations often require specialized knowledge and may have limited compatibility with older vacuum models. Distributors must balance innovative products with proven traditional components.

Future-proofing inventory selections involves monitoring industry trends and manufacturer roadmaps to anticipate upcoming compatibility requirements. Participation in trade shows and industry conferences provides valuable insights into emerging technologies and market directions. Partnerships with forward-thinking suppliers help distributors access innovative products before mainstream market adoption.

Pricing Strategy and Profit Optimization

Competitive Pricing Analysis

Pricing strategies for vacuum replacement parts require careful balance between competitiveness and profitability. Market research reveals significant price variations across different distribution channels, with online retailers often offering lower prices than traditional brick-and-mortar stores. Distributors must consider total cost of ownership, including shipping, handling, and customer service expenses when establishing wholesale pricing structures.

Value-based pricing approaches focus on product benefits and quality differentiators rather than pure cost competition. Premium positioning may be justified through superior materials, extended warranties, or enhanced performance characteristics. Bundling strategies that combine multiple replacement parts can increase average transaction values while providing customer convenience.

Inventory Management and Cash Flow

Effective inventory management directly impacts cash flow and profitability for vacuum replacement parts distributors. Just-in-time inventory approaches minimize carrying costs but require reliable supplier performance and accurate demand forecasting. Safety stock levels must account for supply chain variations and seasonal demand fluctuations to prevent customer service disruptions.

Inventory turnover rates vary significantly across different product categories, requiring customized stocking strategies. Fast-moving consumables like filters and dust bags warrant higher stock levels, while slower-moving specialized components may require drop-shipping arrangements. Regular inventory analysis helps identify obsolete stock and optimize purchasing decisions based on actual sales performance.

FAQ

How do distributors determine the optimal mix of original versus compatible replacement parts

The optimal product mix depends on target customer segments and market positioning strategy. Research suggests a 70-30 split favoring compatible parts works well for price-sensitive markets, while premium markets may prefer 50-50 or higher original equipment ratios. Customer feedback and sales data analysis help refine the mix over time. Distributors should also consider margin differences and supplier relationship factors when making these decisions.

What are the most common quality issues with vacuum replacement parts

Common quality problems include dimensional inaccuracies that prevent proper fit, premature material degradation leading to shortened lifespan, and performance issues such as reduced suction or filtration efficiency. Poor packaging can result in damage during shipping and storage. Establishing clear quality standards with suppliers and implementing incoming inspection procedures helps minimize these issues.

How should distributors handle warranty and return policies for replacement parts

Warranty policies should balance customer protection with operational efficiency, typically offering 90-day to one-year coverage depending on product type and positioning. Clear return procedures that specify acceptable return conditions help prevent abuse while maintaining customer satisfaction. Distributors should negotiate supplier support for warranty claims and maintain detailed records for trend analysis and supplier performance evaluation.

What trends are shaping the future of vacuum replacement parts distribution

Key trends include increasing demand for eco-friendly materials, growth in robotic vacuum accessories, and expansion of subscription-based replacement programs. Digital catalog integration and augmented reality compatibility guides are becoming important differentiators. Sustainability concerns drive demand for recyclable components and packaging, while smart home integration creates opportunities for connected replacement parts with monitoring capabilities.

Table of Contents

- Market Analysis for Vacuum Replacement Components

- Quality Assessment and Supplier Evaluation

- Compatibility and Technical Specifications

- Pricing Strategy and Profit Optimization

-

FAQ

- How do distributors determine the optimal mix of original versus compatible replacement parts

- What are the most common quality issues with vacuum replacement parts

- How should distributors handle warranty and return policies for replacement parts

- What trends are shaping the future of vacuum replacement parts distribution